Despite the economic crisis still affecting many states nationwide, Florida has several cities listed as some of the best places in the United States to invest in rental property in 2021.

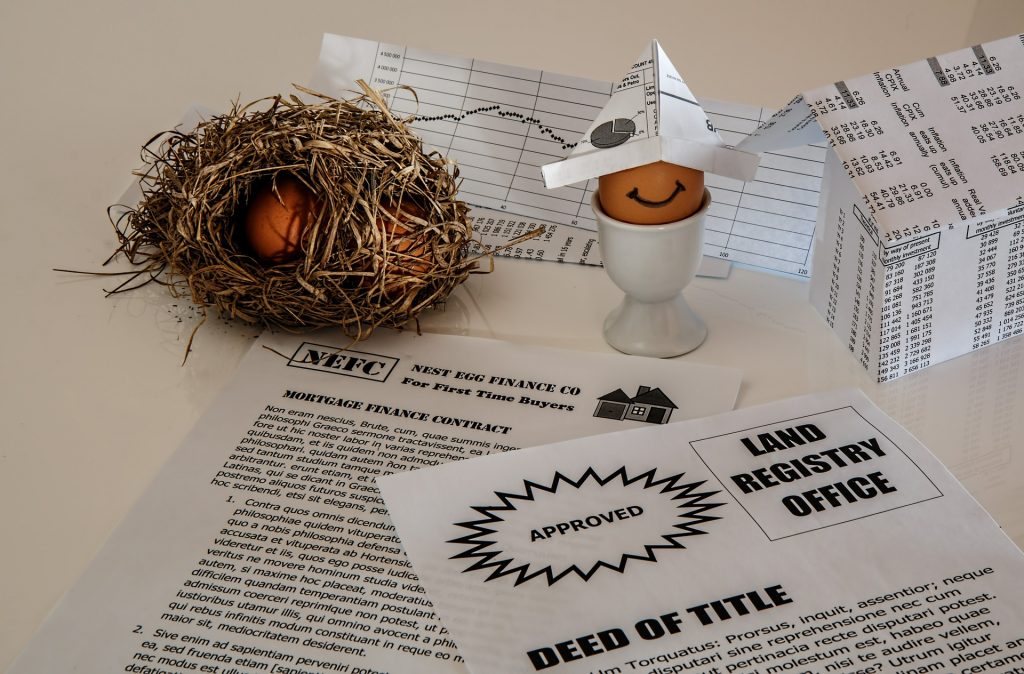

However, it is crucial to be aware of all elements involved in buying or selling real estate in Florida. For example, do you know what a title defect in Florida is? This article will discover what a title defect is and how to deal with them when investing in Florida real estate.

Back to Basics – What Are Title Defects?

The term “title defect” refers to any factors that can make a real estate transaction more complicated. Such complications can potentially delate the property-buying negotiations or preclude someone’s ability to either buy or sell a property.

Also, in many cases, a title defect can render the property’s title unmarketable, making it unsuitable for sale to any buyer. The most common title defects found during title searches in Florida cover various factors, including errors in public records, liens, judgments, and encumbrances.

Most Common Title Defects – In-Depth Assessment

In Florida, both buyers and sellers need to be aware of any title defects. Such defects may bring many issues in the future if the buyer does nothing before the transaction’s closing.

Clerical Errors/Omissions in Deed Recording

The process of deed recording is crucial to ensure that a property title is clean and marketable. Hence, any erroneous description or omission associated with a deed (e.g., incorrect marital status, missing heirs, etc.) will cause the deed to be defective.

Filling Errors / Inaccuracy in Ownership Recording

A title must be properly filed and recorded in the name of the right owner. Otherwise, it can cause unforeseen mistakes if no one corrects the issues before settling the real estate transaction.

Judgment Against Previous Owners

When a court orders someone to pay an owed amount to a creditor, the creditor can use that judgment to place a lien on the debtor’s property. Usually, the only way to get rid of a judgment is to repay the debt before transferring the property title.

Unknown Liens

A lien attached to the title of a property indicates that someone who is not the rightful owner has rights to a share of that property. Typically, a lien is an indication that the property’s owner has unsettled debt(s) that resulted in a lawsuit against him/her.

Undiscovered Encumbrances

Unknown encumbrances refer to any third parties’ claims to real property, whether it refers to a right to use the property or a right to possess a share of the property.

Typically, encumbrances can be either a long-forgotten, hidden mortgage or a restrictive covenant associated with the property’s original title. Therefore, it is essential to find encumbrances before closing any real estate transaction.

Adverse Possession

In real estate law, the principle of adverse possession permits an individual who possesses the land of a third party for an extended period to claim title to the property.

Unknown Easements and Boundary Disputes

Boundary disputes and easements are similar issues. Typically, both of them happens when someone makes a mistake while surveying the land of a property.

When the error goes unforeseen, it can carry on throughout the time and affect new property owners many years after the event. Usually, boundary disputes can result in claims on a portion of a property, which can be costly and stressful for property owners.

False Impersonation and Forgeries

Unfortunately, many criminals use false impersonation and forgeries to transfer property ownership without the consent or knowledge of its rightful owner.

How to Deal with Title Defect in Florida Before It is Too Late?

First, it is crucial to work with an expert title company to assess your situation and ensure the best outcome for any real estate transaction.

Before the closing, it is fundamental to proceed with a title search to find any undisclosed errors that may affect the validity of the title. During this process, a title expert will double-check the title of a property and access notary and database archives to ensure the document is clean.

Nonetheless, on rare occasions, some title faults can remain hidden even after proceeding diligent search. In this sense, it is recommendable to buy a title insurance policy to provide coverage against potential title “clouds.”

Work with Marina Title to Get Rid of Title Defects

At Marina Title, we have a team of experienced title attorneys to ensure your peace of mind during the acquisition of real property in Florida. Call us today at (855) 513-5880 or email us at Info@MarinaTitle.com to schedule a consultation.